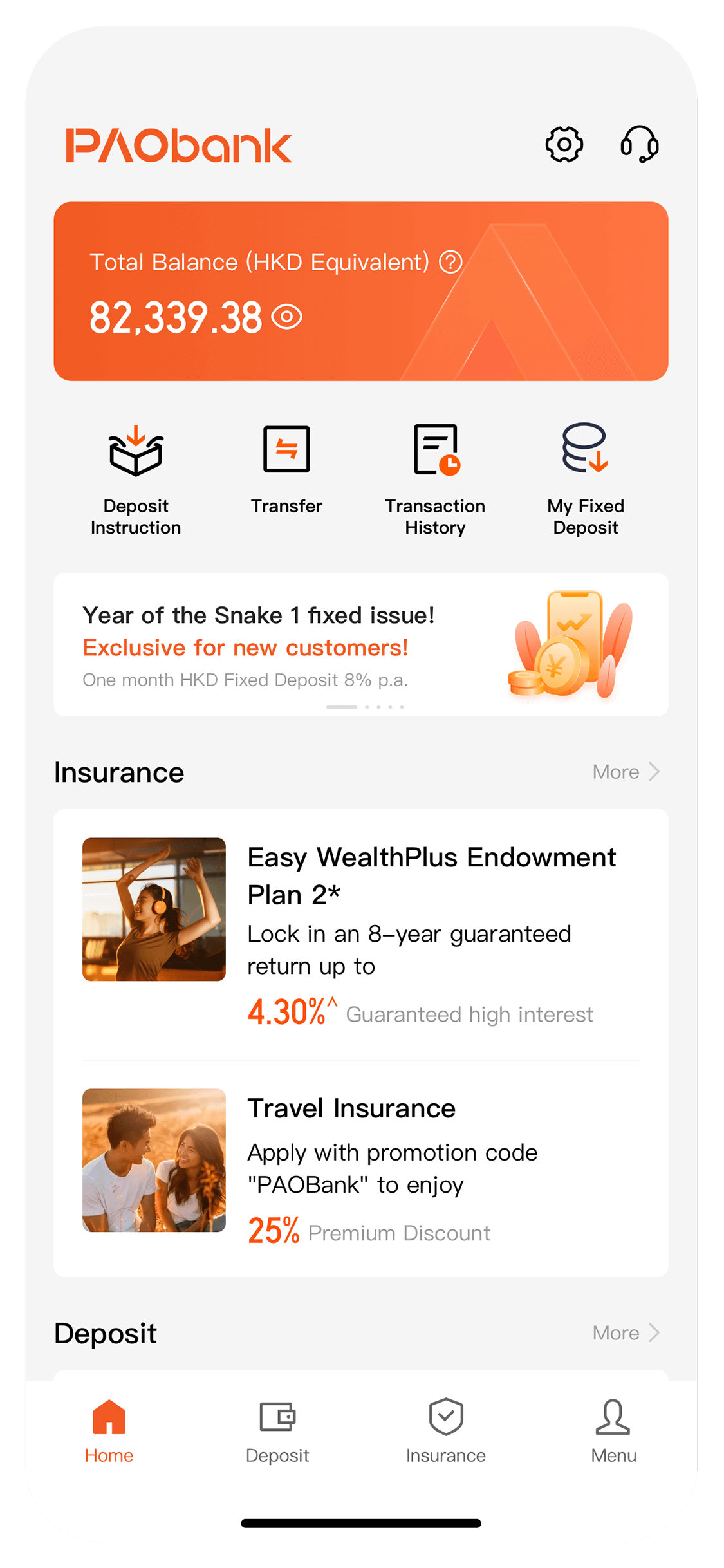

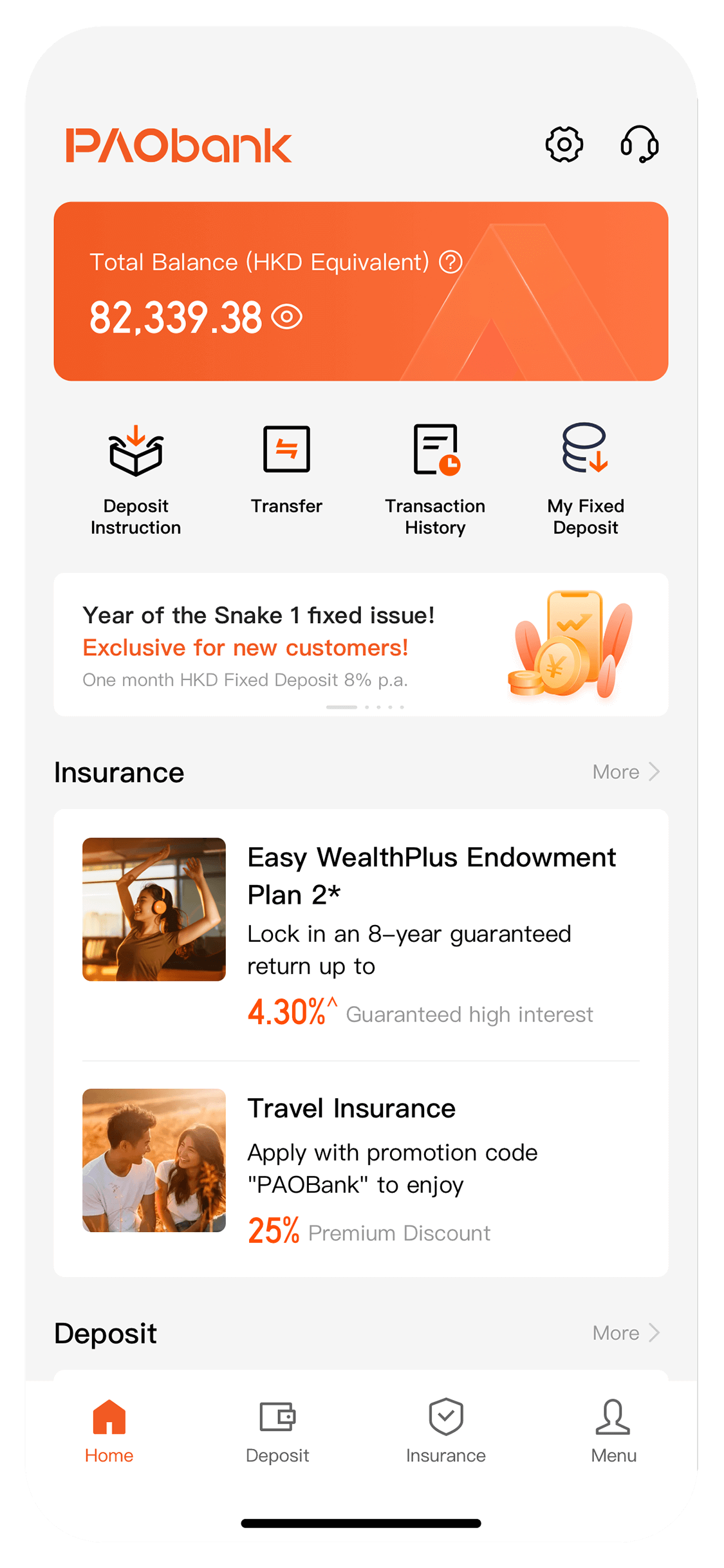

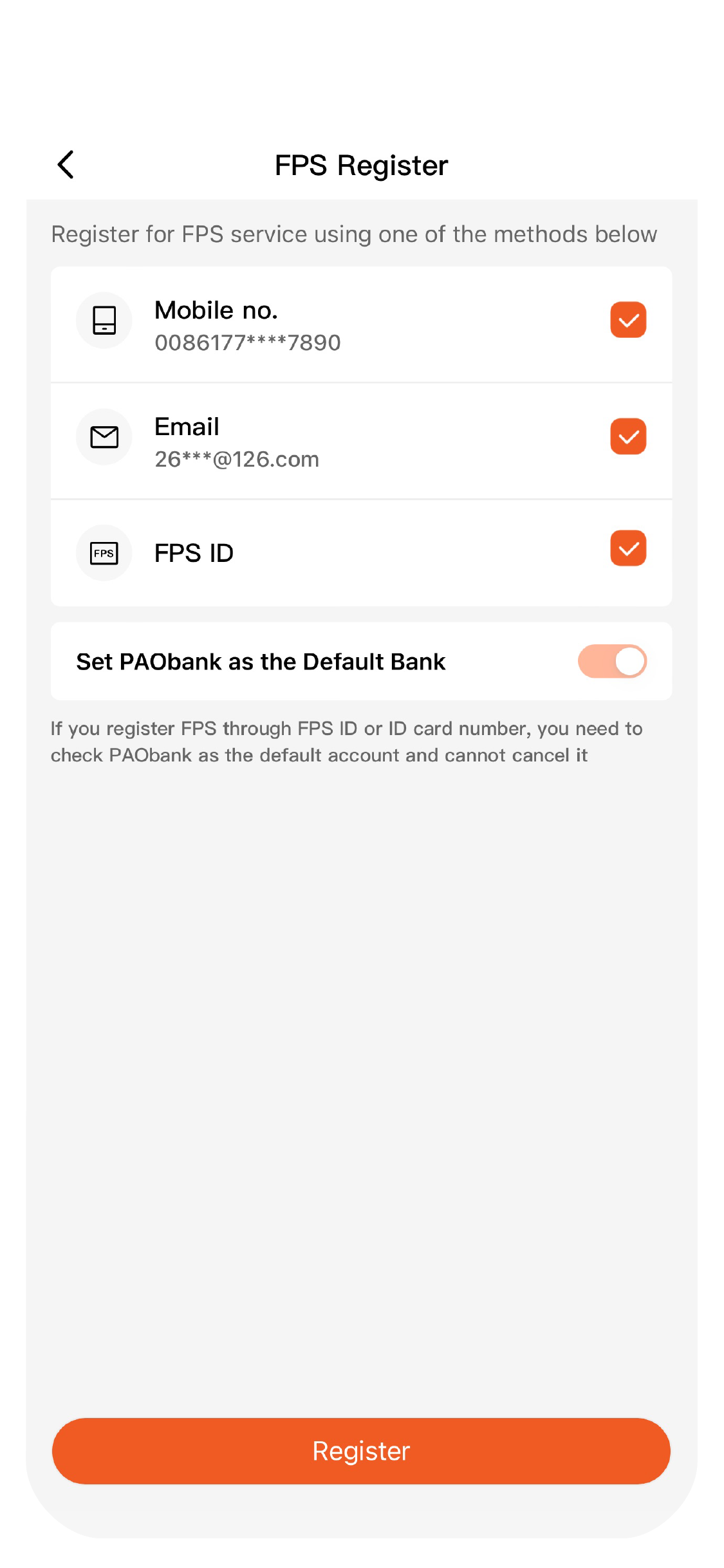

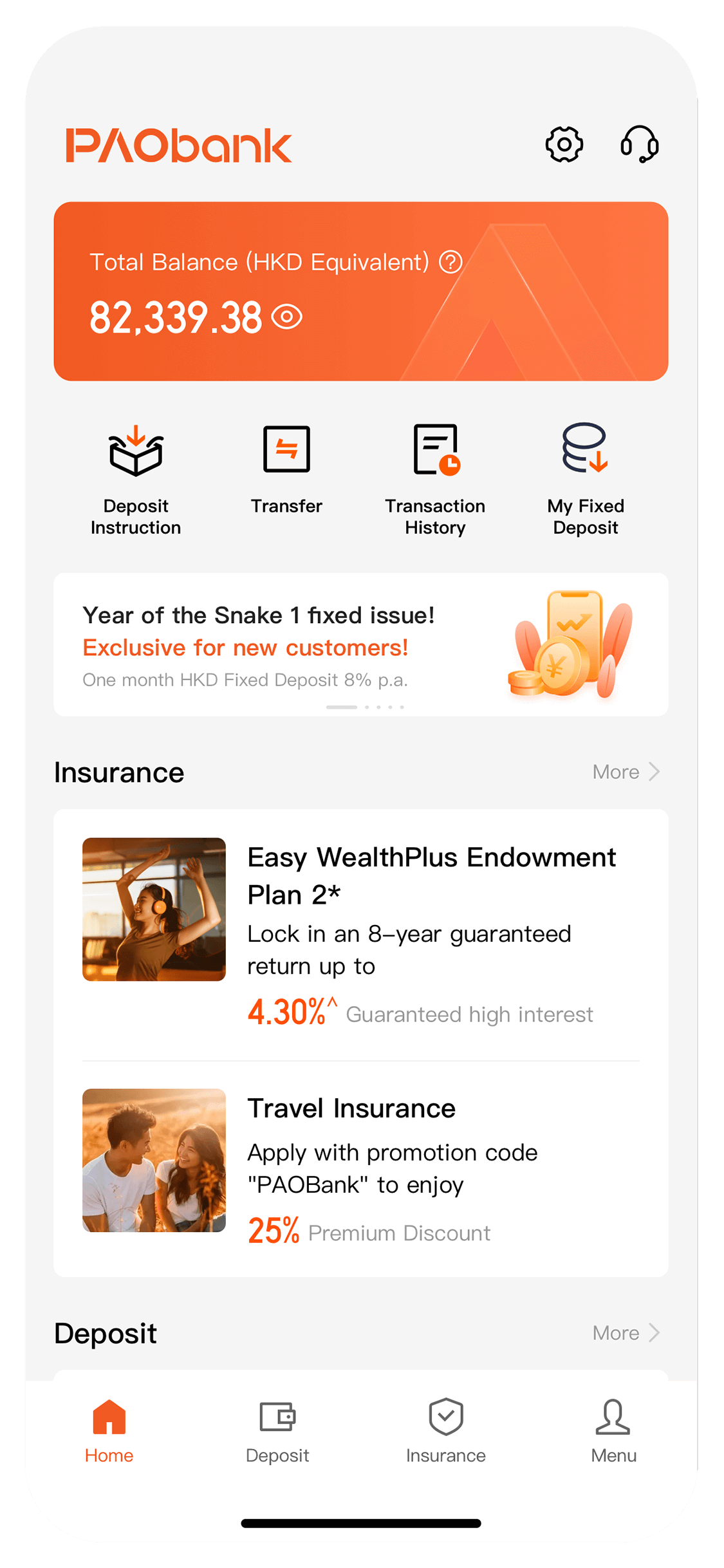

Faster Payment System (FPS)

Don’t forget to uplift your Transaction Limit before you transfer!

7x24

7x24 Instant fund transfers

Instant fund transfers

Cross-bank transfers without fees

Cross-bank transfers without fees Safe and secure

Safe and secure

Transfer to other PAObank accounts

Don’t forget to uplift your Transaction Limit before you transfer!

7x24

7x24 Instant fund transfers

Instant fund transfers

Transfers without fees

Transfers without fees Safe and secure

Safe and secure

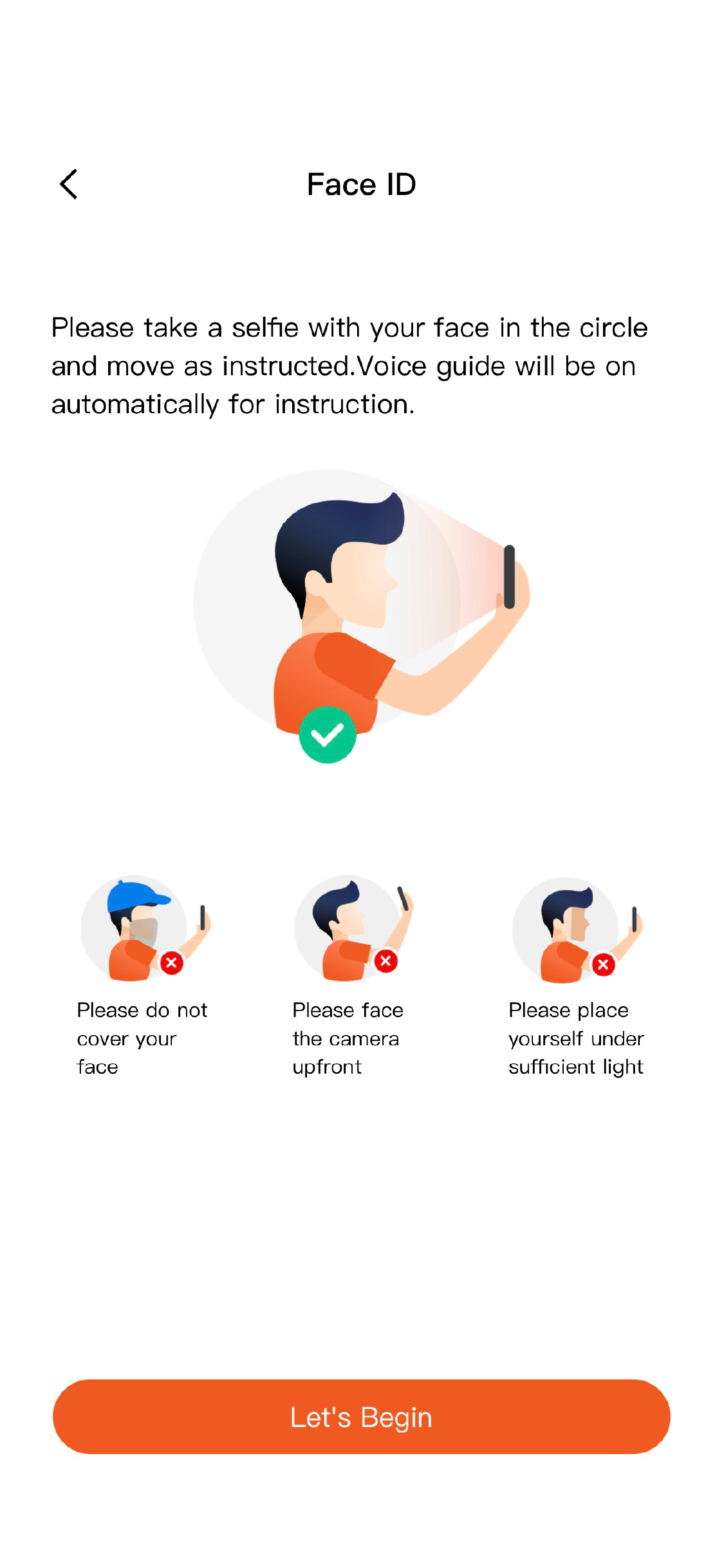

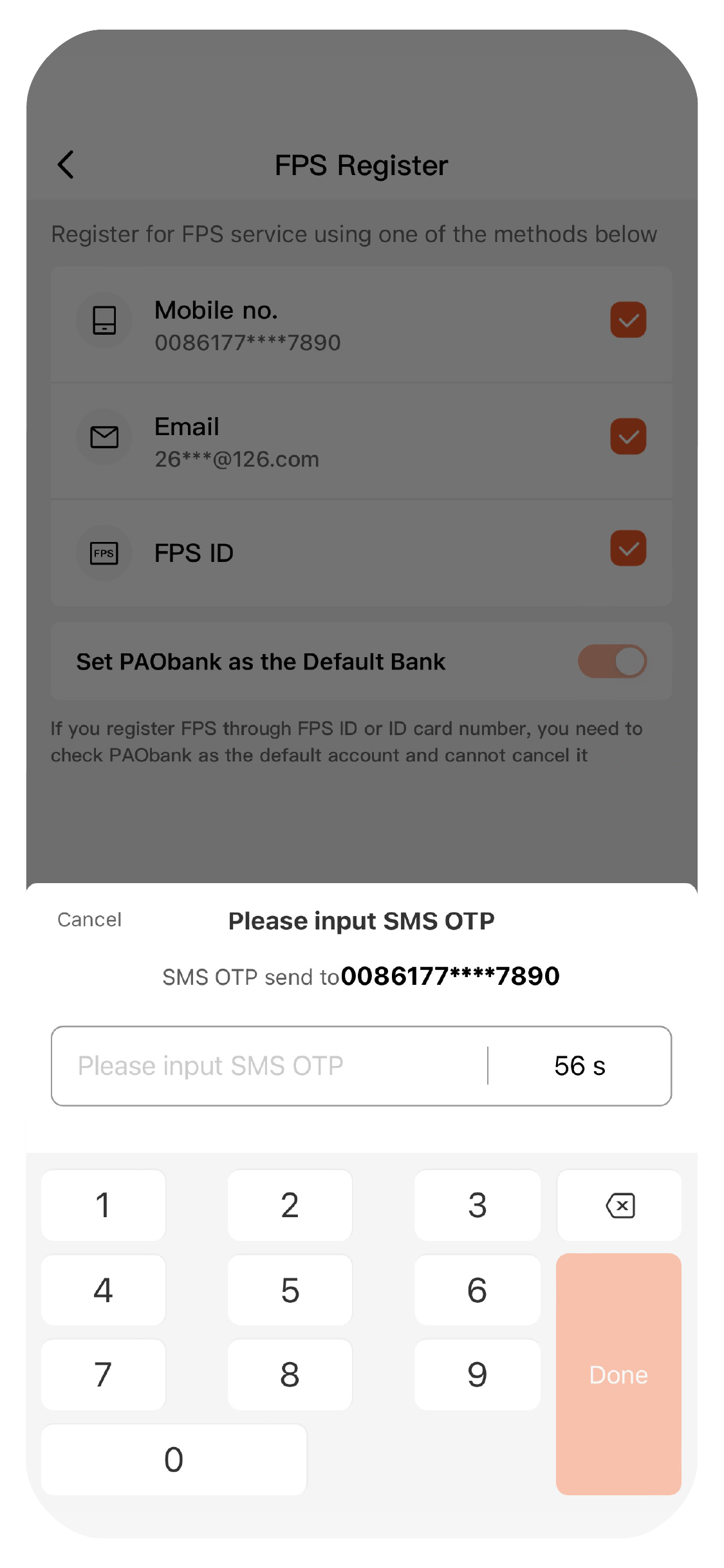

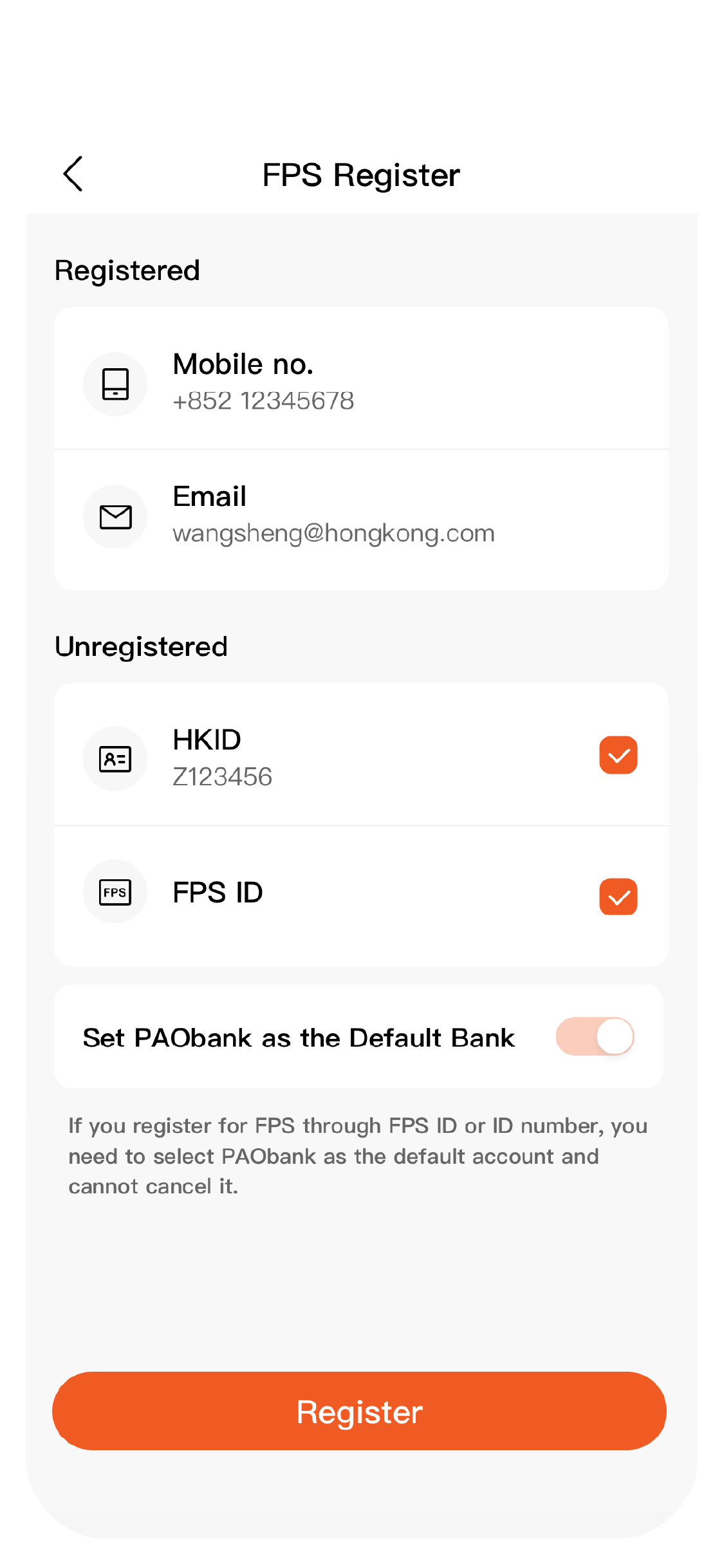

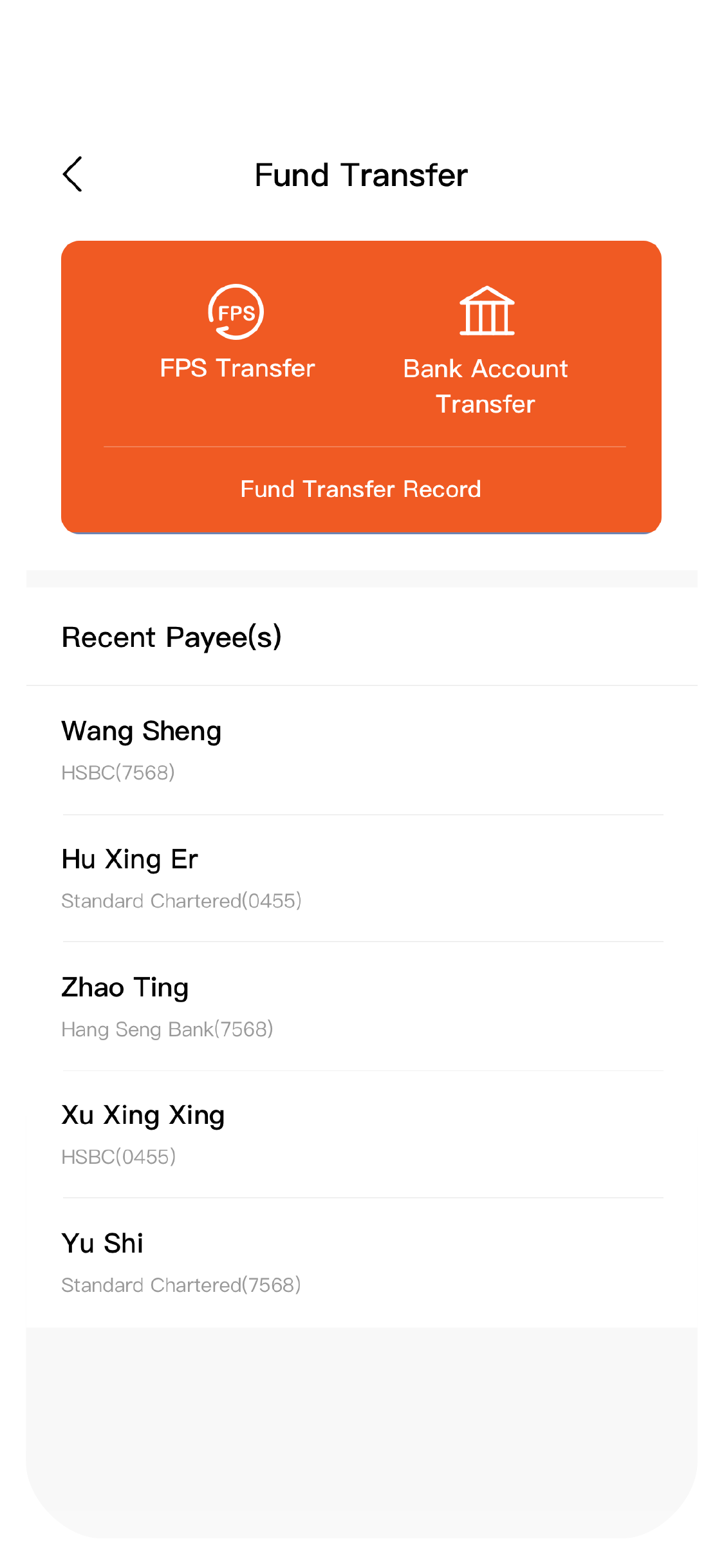

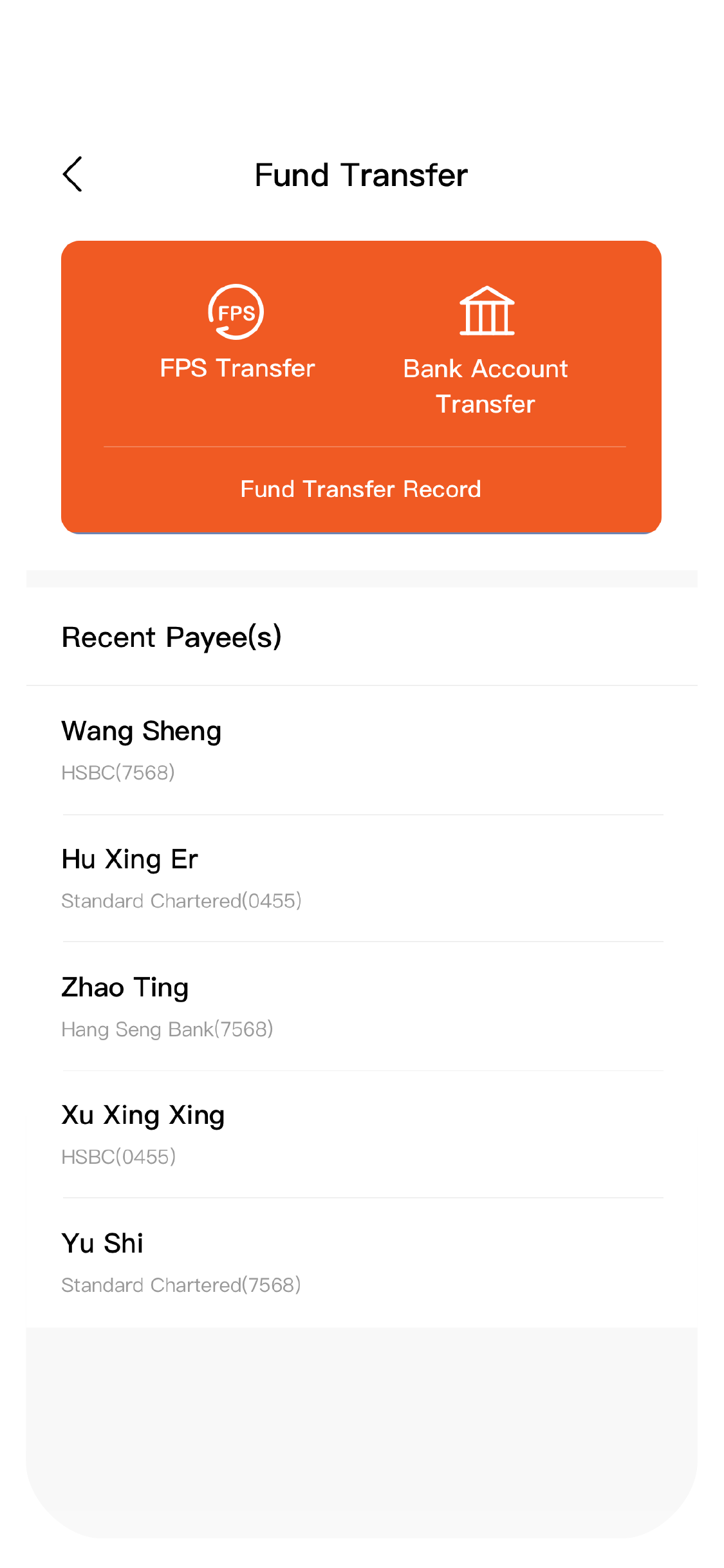

1

Click “Transfer” 2

Select “FPS Transfer” 3

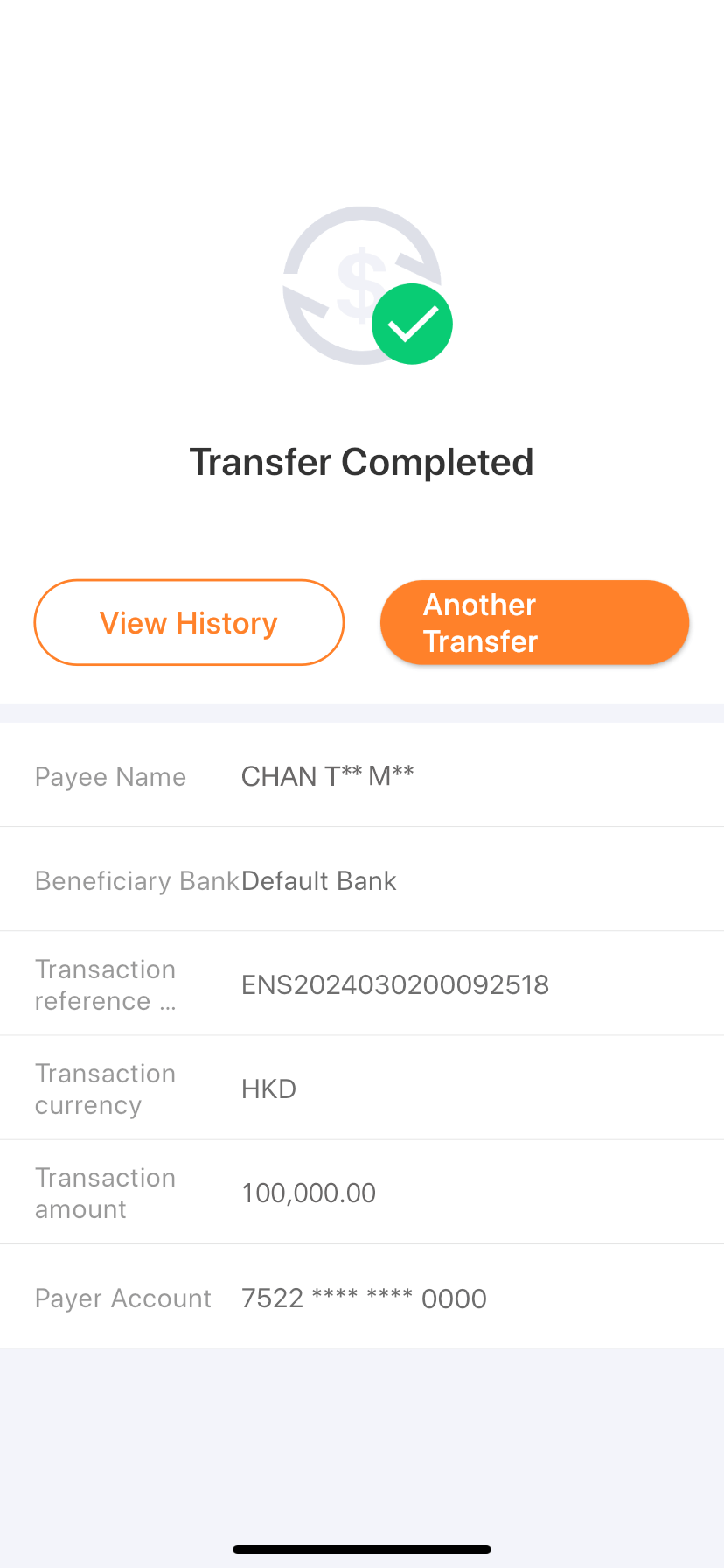

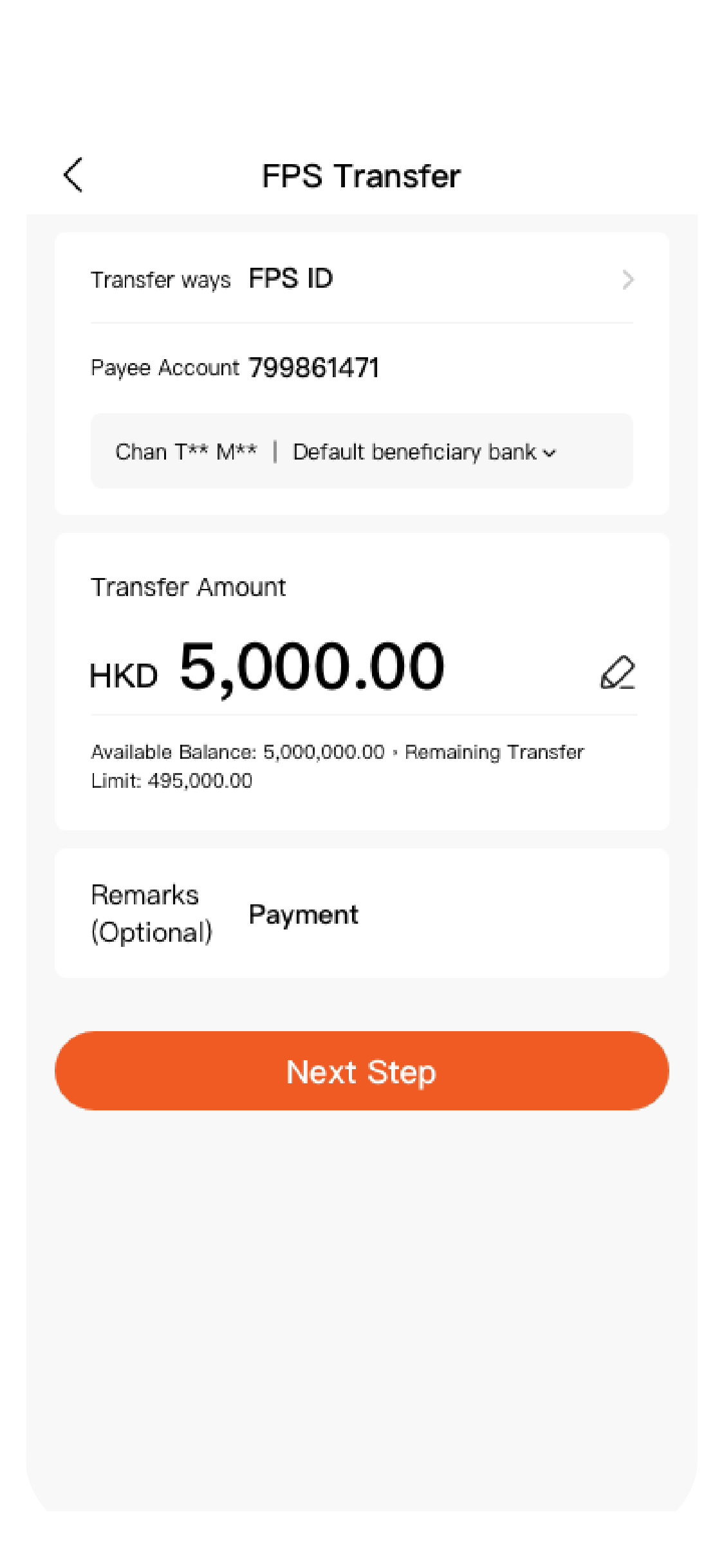

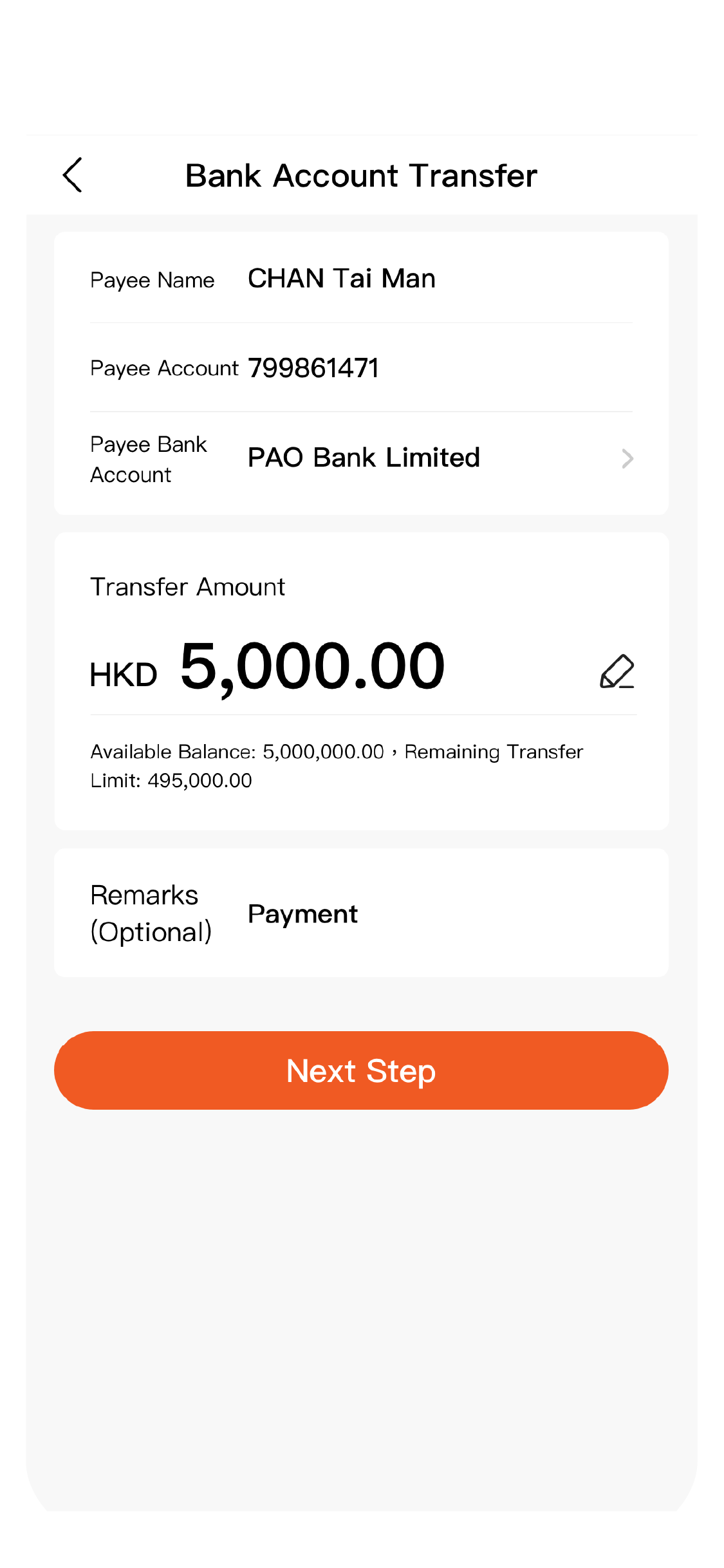

Input payee’s mobile number / email address / FPS ID. Select receiving bank and input transfer amount. 4

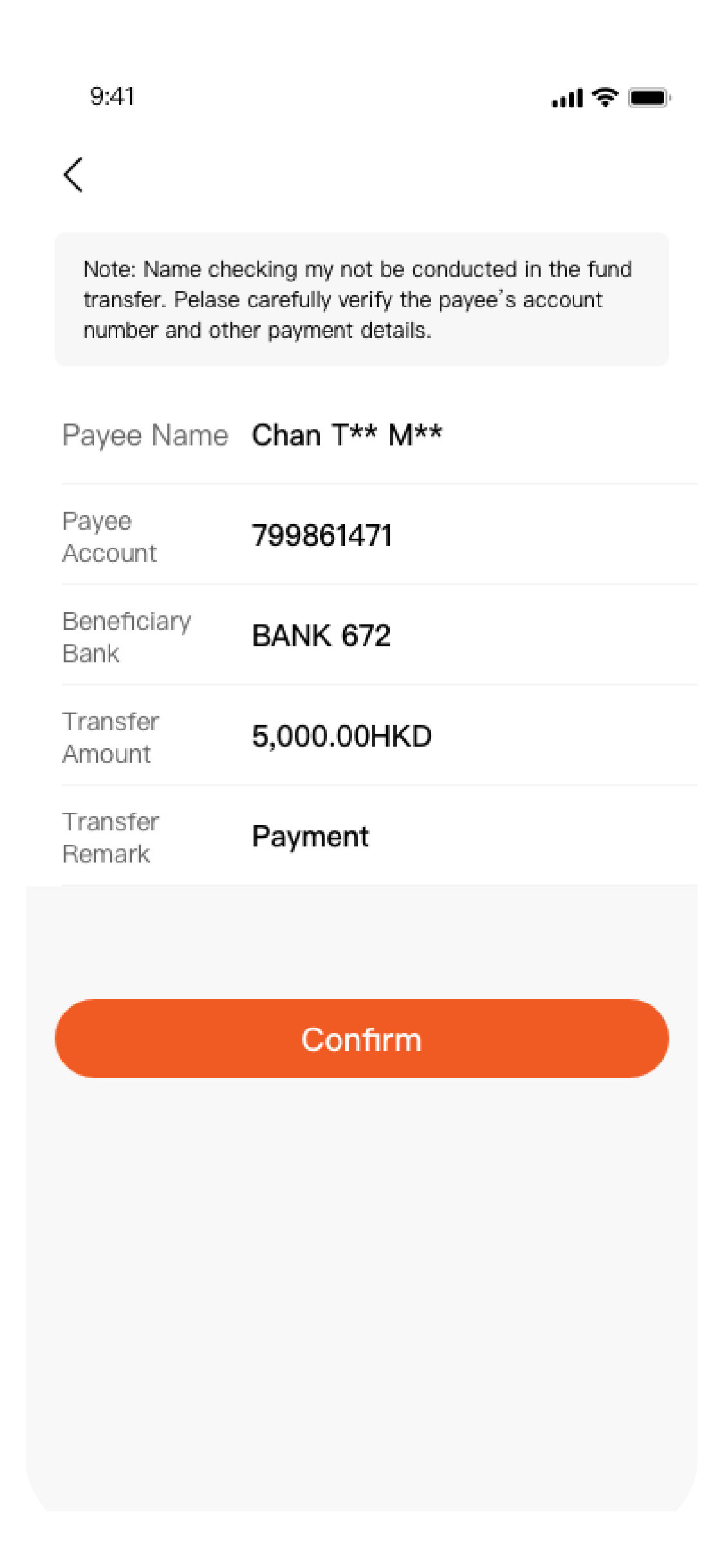

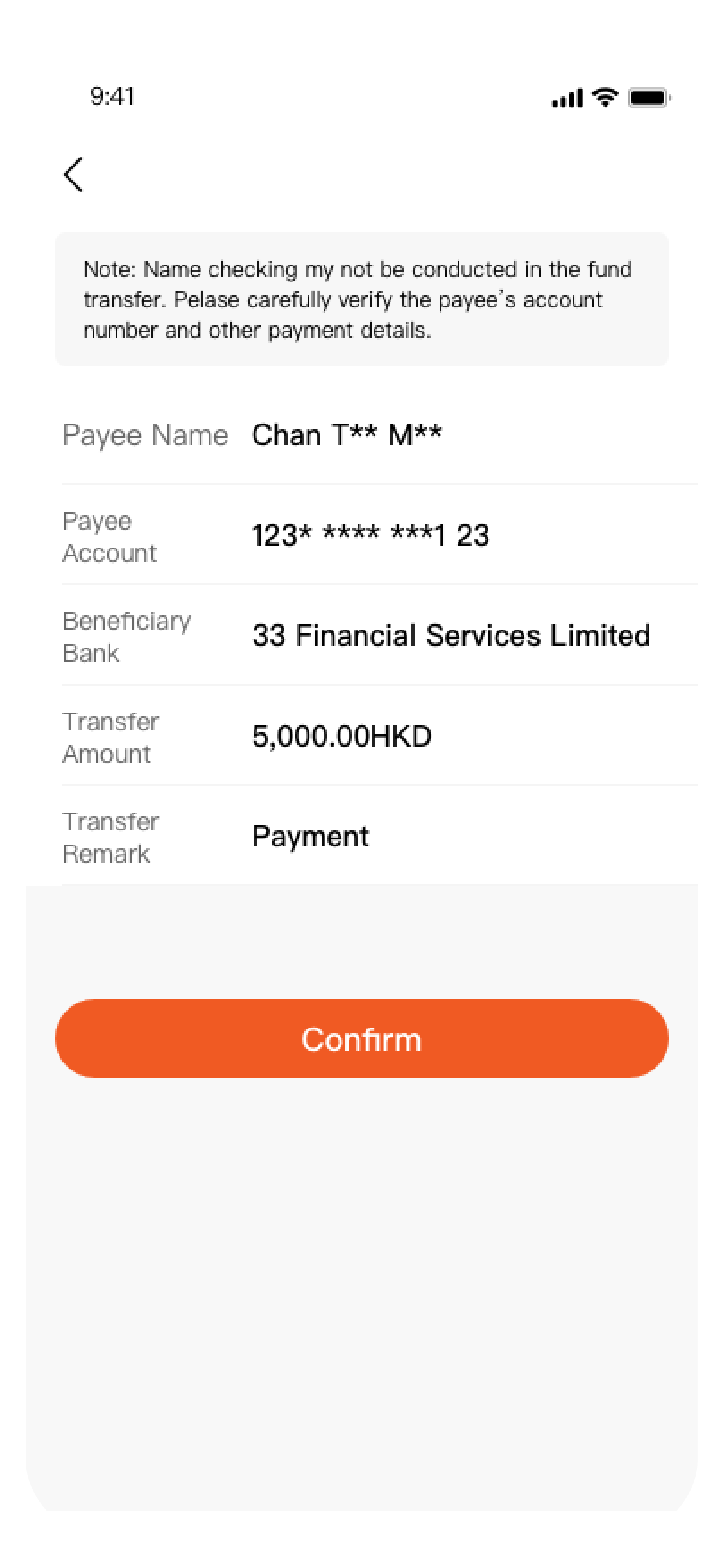

Verify the transaction details and click “Confirm”. 5

DoneSmart Tips:

- Before confirming a transfer or deposit of funds to a third party in Hong Kong, you are advised to verify the account number/mobile number/email address/FPS identifier and partially-masked name (if available) of the payee carefully to avoid mis-transfer of fund. After giving the instruction, you are advised to check with the transferee to confirm the receipt of fund. If you find the fund was mis-transferred to third-party account, please report to our Customer Service Representative at (852) 3762 9900 (24-hour service) at the earliest convenience.

- It is our responsibility to remind you if you have received funds which a transferor sent by mistake, you should contact our Customer Service Representative at (852) 3762 9900 (24-hour service) at the earliest convenience. You could be criminally liable if you refuse to return the fund to the transferor.

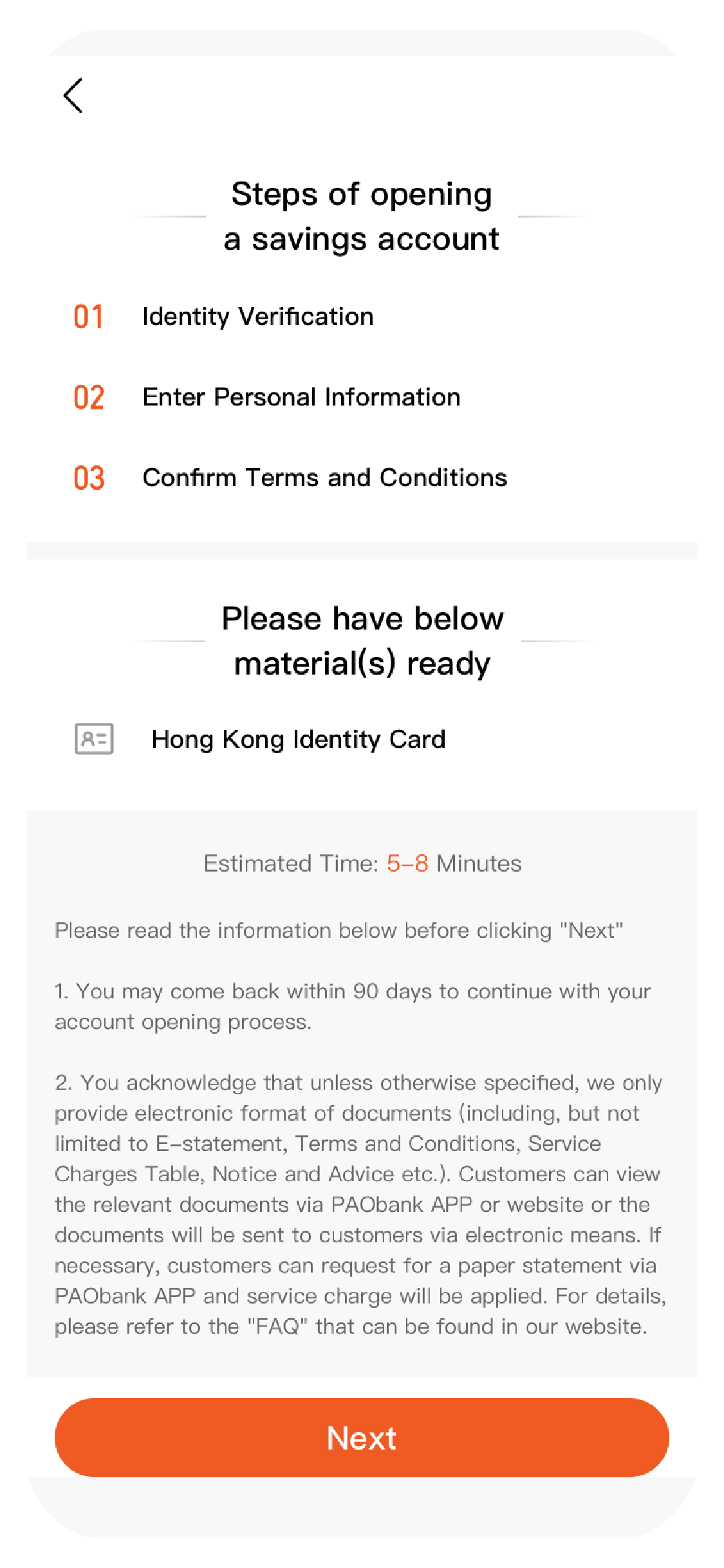

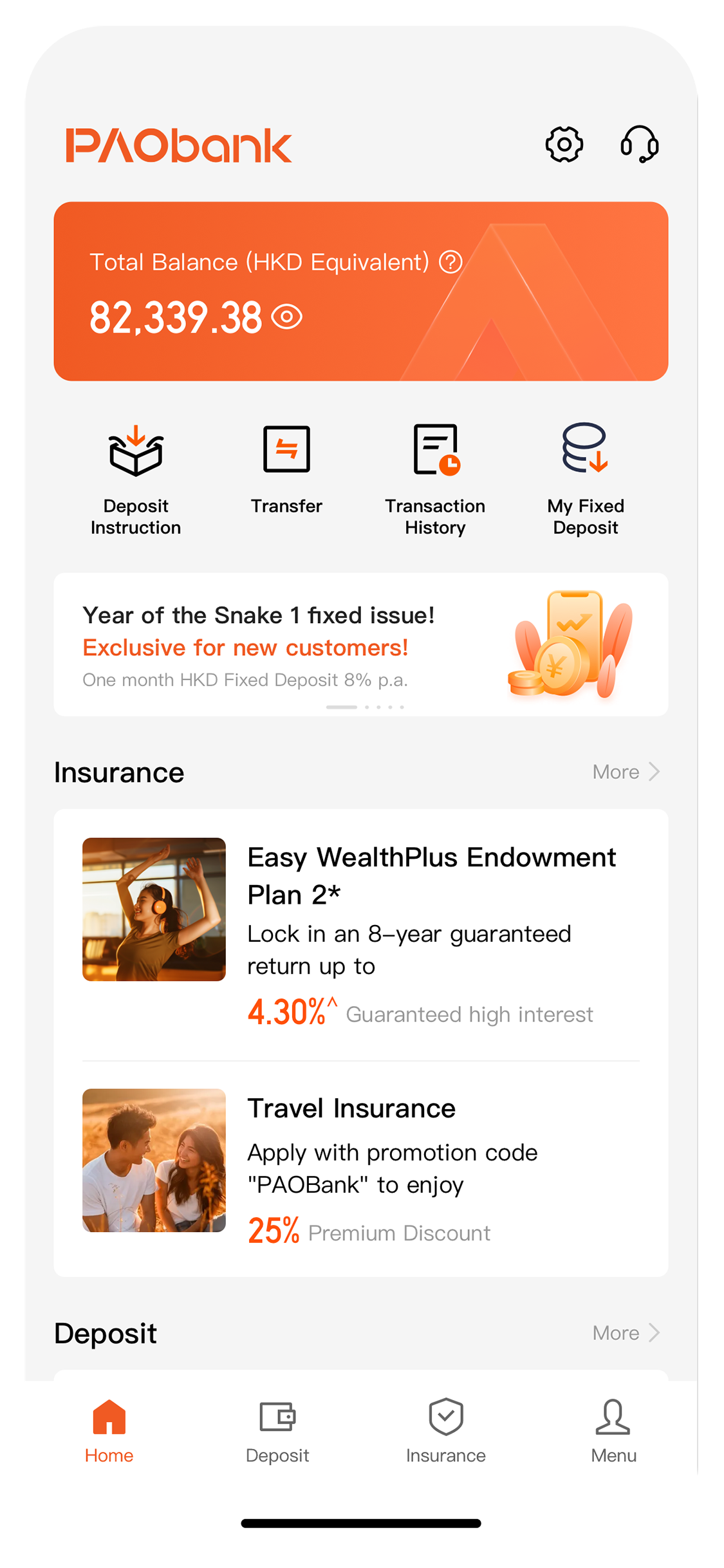

Savings Account

Enjoy a basic saving interest rate of 1% p.a. with NO fees and NO minimum account balance requirement 1

Enjoy a basic saving interest rate of 1% p.a. with NO fees and NO minimum account balance requirement 1 Transfer funds from your account INSTANTLY at your fingerprints

Transfer funds from your account INSTANTLY at your fingerprints Enjoy 24/7 banking services WITHOUT visiting a bank

Enjoy 24/7 banking services WITHOUT visiting a bank Go green with paperless statement

Go green with paperless statement Eligible deposits under Deposit Protection Scheme (DPS) in Hong Kong

Eligible deposits under Deposit Protection Scheme (DPS) in Hong Kong- 1 Applicable to account balance at HK$1M or below. 0.01% p.a. interest rate will be applied for account balance over HK$1M.

Bonus Step-up Campaign

Selected customers who open account and deposit funds on or before 30th Jun can enjoy saving interest rate up to 5%. p.a.. Eligible deposit amount for this campaign is up to HK$1,000,000.

Learn moreInterest Rate

Period

0 - 200 K

200 K - 20M

>20M

Account opening date to 30 Sep 2020 (both dates inclusive)

2%

1%

0.01%

1 Cot to 31 Dec 2020 (both dates inclusive)

3%

1%

0.01%

1 Jan to 31 Mar 2021 (both dates inclusive)

5%

1%

0.01%

Remark:

- Eligibility cap is based on initial deposit and will be adjusted downward per fund withdrawal

- Eligibility cap will not be adjusted upward on subsequent fund deposit

- Bonus step-up interest will be credited to customers savings account 1 month after each period end

Personal Instalment Loan

Personal Instalment loan helps to meet your financial needs!

Apply anytime & anywhere via our APP

Apply anytime & anywhere via our APP HK$0 handling fee

HK$0 handling fee Fully repay the loan anytime with NO early redemption charge

Fully repay the loan anytime with NO early redemption charge

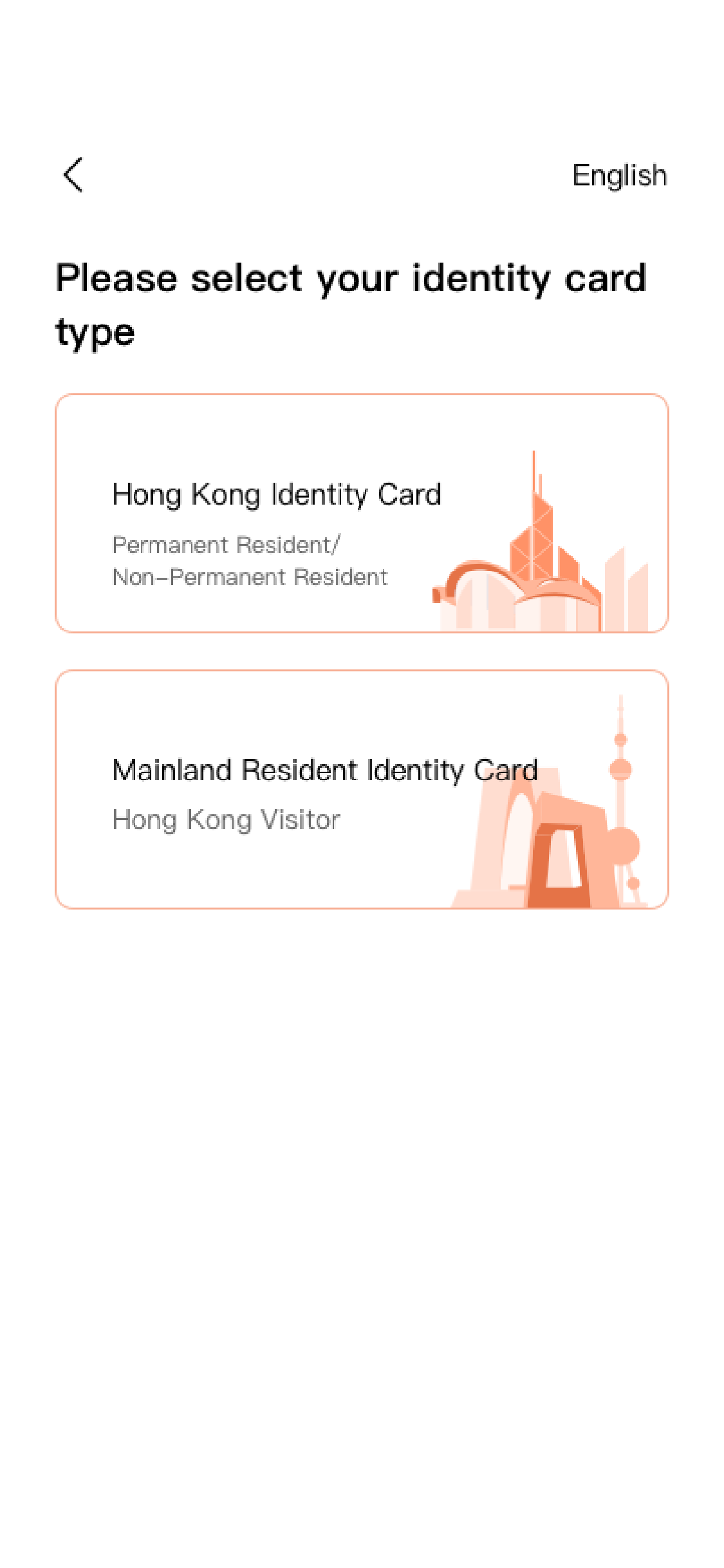

Eligibility

You must be a Hong Kong resident aged 18 or above; and

You must be a Hong Kong resident aged 18 or above; and You must be a Filipino Domestic Helper; and

You must be a Filipino Domestic Helper; and You must be an existing customer

You must be an existing customer

Required Documents

Hong Kong Identity Card

Hong Kong Identity Card Passport

Passport Working Visa

Working Visa Employment Contract

Employment Contract Residential Address Proof

Residential Address Proof

To borrow or not to borrow? Borrow only if you can repay!

Remarks:

- The Bank reserves the right to designate relevant documents and request for additional documents for the loan approval.